Author: Kevin J. Delaney

Author: Kevin J. Delaney

Publisher: New York University Press

Book Review by: Nano Khilnani

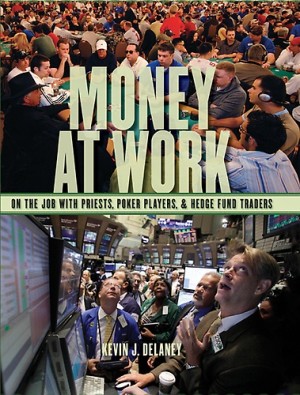

Money has become a very important part of our lives, pervading our daily thoughts, actions and conversations with our spouses, family members, friends and even telemarketers. This book is about money in our work-a-day world and it enables you to understand your thoughts and feelings about both.

I dare say that if you are currently not happy about money and / or work in your life, this book, through self-examination and reading about others’ experiences, can help you acquire happiness.

If you have not read or heard of “money culture,” Kevin Delaney writes that how you think of money is not only the product of your family’s attitudes and conversations about money as you were growing up, but also your experiences in different jobs as an adult.

A group’s attitudes, beliefs, experiences and practices with money that are “socially transmitted,” constitutes its money culture, Delaney points out.

Priests will talk differently about money than poker players, and poker players may have “an easy-come, easy-go” attitude toward cash, and express that in their conversations with others.

And hedge fund traders, who deal in large amounts of money, would have a more detached view of money, as they see figures, but do not see it physically. They probably would be hard-pressed to visualize it or imagine how many stacks, or pallets of $100 bills the money would be, and how many dollars on each pallet.

We do see those images of pallets on the Internet though, when we type in $1 billion or $1 trillion, for instance in the search field.

In short, our jobs influence to a large part, our thinking on money, Delaney explains. In different occupations, there are different money cultures. He writes: “what people do for a living has a profound effect on how people conceive of money both at work and in their personal lives.”

Our values are shaped by our thoughts on and experiences with money, Delaney writes, and in this book, he shows clear connections between the economic and social aspects of our lives.

To illustrate his basic thesis in this book that your work deeply affects your financial outlook, daily thoughts and conversations, and feelings about money, Delaney gives examples of two people with starkly different money cultures: one a hedge fund trader and the other a former commission salesperson who had decided to transform himself by going to Kenya and helping some of the world’s poorest people.

In the first example, the author writes about a conversation that the partners in a Wall Street hedge fund were having:

“We (the partners in the hedge fund) were sitting around the office last week when one of the guys asked me, ‘What’s your number to walk away?’ And I said ‘I don’t know. I haven’t really thought about it.’ And he said, ‘Oh come on, you must have thought about it! What’s your number?’ ‘I don’t know,’ I said, ‘ten million?…Then you could relax…You wouldn’t have to worry about it.’

In the second example, Delaney relates the story of a man “who had left his job in commission sales to work for an organization running seminars and retreats on money and spirituality. As we sat in a small coffee shop, I listened carefully to this man who had been leading what he called ‘reverse mission trips’ to Kenya, the goal of which was not to transform others but to transform oneself by working with the world’s poor.”

“As he prepared for his seminars and trips, continuing to deepen his own spiritual and religious faith, he became inspired by the biblical story of manna, which carries the message that all will have enough but none will have too much….his desire was to constantly test new thresholds for giving up money and possessions…”

Kevin J. Delaney, a professor of sociology atTempleUniversity, has broken new ground by writing about the relationship between people’s thoughts on money and the kinds of jobs they do.