By Patrice Hill – Washington Times

The Federal Reserve on Wednesday signaled strong concern that the deepening European debt crisis could drag down the U.S. economy and moved to prop up growth.

After two weeks of reports showing a rapidly weakening economy in April and May, the Fed’s rate-setting committee voted to extend the central bank’s current easing programs and said it would take further dramatic action if the U.S. economy continues to deteriorate.

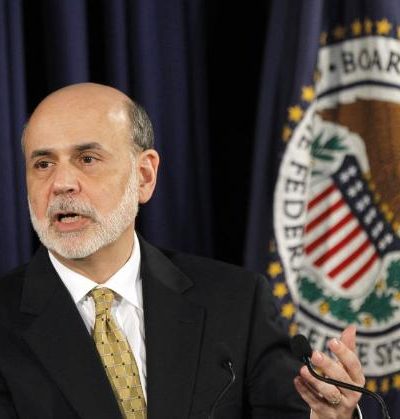

Ben S. Bernanke, chairman of the Fed, made it clear at a news conference after the committee meeting that he sees the crisis in Europe as the biggest danger for the U.S. economy, but he said it also is being held back by lingering weakness in the housing market and big cutbacks and layoffs by state and local governments.

“We are prepared to do what is necessary” to ensure the economy keeps growing, he said, although he added that recent reports showing a sharp slowdown in job growth and consumer spending were “not entirely clear” about the extent of the slowdown and the Fed will continue to scrutinize economic reports closely in coming weeks before deciding whether to take further action.

Pessimism about the domestic economy was underscored further with the release Wednesday of a sobering report from the Business Roundtable.

The group’s CEO, John Engler, said the uncertainty facing business owners “is pretty lethal.” Companies are afraid to hire, he said, and are “holding back for some clarity.”

Other businesses and private economists have sounded a similar note, blaming the slowdown this spring on uncertainty created in part by a fiscal crisis looming at the end of the year, when $600 billion of tax increases and spending cuts will take effect.

But Mr. Bernanke said it is too early for that year-end deadline to be having much effect on the U.S. economy.

He attributed the current weakness primarily to the European crisis and lingering aftershocks from the recession.

“The European situation is slowing U.S. economic growth,” he said, noting that many countries in Europe have fallen into recession and “that affects our trade” and demand for U.S. products. Europe is the largest export market for U.S. producers.

Europe’s downturn also has precipitated a major slowdown in China, which is the fast-growing market for U.S. goods, he noted. And the big swoon in the U.S. stock market triggered by the intensification of the European crisis this spring also poses a risk for the U.S. economy, he said.

In light of the Fed’s renewed concerns about the U.S. economy, many Fed-watchers now expect the central bank to launch another of its controversial bond-buying programs later this year, despite the heightened political atmosphere and criticism that is likely to generate from conservatives opposed to such unconventional measures.

Republican presidential candidate Mitt Romney, among others, has criticized such unconventional Fed programs, saying they are ineffective and raise questions about the central bank’s commitment to fighting inflation.

But Mr. Bernanke strongly defended the programs and emphasized several times in his news briefing that the Fed still views them as “ammunition” that it can deploy to get the economy moving faster.

He said that past bond-buying programs were successful not only at reducing interest rates to record lows but at prompting investors and banks to put more of their money into lending to consumers and businesses as the Fed buys up more and more of the Treasury securities and mortgage bonds they are holding.

Despite the political opposition, “Bernanke was making the case for additional quantitative easing,” said Paul Edelstein, economist at IHS Global Insight, adding that further “drastic action” may be on the way.

“The Fed is keeping it’s powder dry in case things spin out of control in Europe,” said Terry Connelly, dean emeritus at the Golden Gate University’s business school. He expects the Fed will launch a new round of bond-buying after the Fed’s annual meeting in Jackson Hole, Wyo., in August.

Investment strategist Andrew B. Busch was surprised that the Fed is resurrecting its controversial bond-buying programs.

“They risk serious political blowback if they act overly aggressive in the middle of an election that is extremely close and centered on the economy,” he said.

Mr. Bernanke also did not hesitate to insert himself into the growing political brawl over what to do about the “fiscal cliff” at the end of the year. The Fed chairman was the first to warn Congress this year about the dangers the fiscal crunch poses for the economy.

But Wednesday, Mr. Bernanke appeared to downplay concern about the deadline and instead encouraged Congress and the administration to use the occasion to take major action to address the budget deficit. He said Congress should avoid any simple extension of tax cuts or suspension of planned cuts in discretionary spending, which he said would risk rousing fears in global markets about U.S. debts and deficits getting out of control.

Brian Gardner, senior vice president at Keefe, Bruyette & Woods, said the Fed is more worried than Mr. Bernanke let on, and likely is making plans to offset any damage to the economy at the turn of the year if Congress fails to avert a fiscal crunch.

“If Congress fails to extend the tax cuts and lets [budget cuts] proceed as planned, then the Fed may step in to counter the expected fiscal drag,” he said.

According to Wednesday’s Business Roundtable report, 75 percent of CEOs expect sales to increase over the next six months, down 6 percent from the previous survey.

Boeing Chief Executive W. James McNerney Jr., chairman of the Roundtable, blames the slowdown in part on the federal regulatory environment.

“The attitude [about regulations] is different [than in the past],” he added. “We’d just like to see it balanced. We’re not arguing regulation is bad. We need regulation, but it’s gone way beyond that, and it has an effect on business.”

• Tim Devaney contributed to this report.