NEW YORK, NY – In our column last Sunday 30 December – Boosting Exports Can Grow Philippine Economy – we mentioned that the Philippines had a worldwide net trade deficit (imports larger than exports) of $34.08 billion representing 11.2 percent of the country’s $314 GDP in 2017 per US Central Intelligence Agency (CIA) data.

The Philippines Statistics Authority or PSA indicated in an April 11, 2018 report that the country’s total imports of goods in 2017 were $96,093 million and exports were $68,712 million, resulting in a trade deficit in goods alone of $27,381 million. Dollar amounts for import of services were unavailable so let’s say the services trade deficit was $6,699 million, adding up to the $34,080 million trade deficit ($102,792 million in imports minus $68,712 million in exports = $34,080 million trade deficit0

Philippine exports by category are: Agricultural products: abaca, bananas, cassava, coconuts and coconut oil, corn, cotton, pineapple, rice, rubber, sugarcane, and tobacco; Clothing and footwear; Copper products; Dairy products; Electronic components and parts; Gold and nickel ore, Livestock, poultry and marine products like fish and other seafood; and Transport equipment.

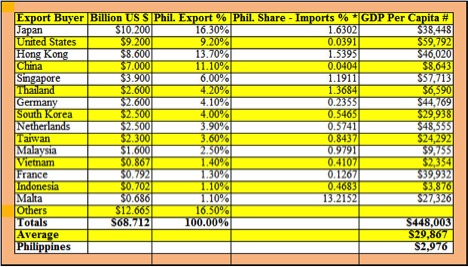

The top 15 Philippine export buyers in 2017 – who bought $56+ billion or over 80 percent of total exports – are shown in the table above, based on data gathered from an international trade research organization. Percentage figures are different due to rounding. The column with an asterisk shows the tiny Philippine shares of that country’s huge total imports worldwide, where we can capture the untapped potential. The column with # shows many countries’ residents with larger-income purchasing power.

What’s very important to know: all of these countries with the exception of Japan increased their purchases in 2017 compared to 2016. The largest percentage of increase was from the smallest buyer Malta that more than tripled their buys (308 percent) and the smallest increase was by Singapore (why?). Our largest customer Japan cut their purchases by 12.4 percent from $11.6 billion in 2016 to $10.2 billion in 2017(why?)

What do the above data tell us, and what should be done to increase our export earnings? We see several important observations, some questions to find answers for, and then take the necessary actions to increase our export revenues:

- In 2017, global exports totaled $17.585 trillion where the $68.712 billion Philippine exports represent a very thin – less than four-tenths of one percent – slice of this mammoth global export pie. There’s vast opportunity worldwide to boost sales. I believe a prudent way to grow is from the base we already have – learning which product lines we’re competent to supply more of with better quality, larger quantities, and quicker delivery.

- More than 70 percent of the dollar value of Philippine exports in 2017 went to Asian-Pacific countries (10 of the top 15 export buyers) having lower freight costs to those destinations than to the US, Europe, and to Malta, south of Italy. Philippine trade authorities can negotiate lower freight costs with shipping-airline firms, thereby becoming more competitive than other supplying countries.

- Why did Japan buy less from us in 2017 than in 2016? Having dealt with Japanese customers during my 20 years of export business, they’re very particular about many aspects of business including product quality, timely shipping, and quick answers. Finding out the ‘whys’ and acting on them can lead to increased export sales to Japan.

- The special relationship that exists between the United States and the Philippines can be cultivated to vastly increase Philippine exports to that largest market with $19.4 trillion GDP. The US bought only $9.2 billion of goods in 2017 from the Philippines – less than four-tenths of one percent (0.0391 percent) of $2.352 trillion US imports!

- Hong Kong residents have strong purchasing power with an average annual income of $46,020. Numbering only 7.36 million people, they bought $8.6 billion worth of goods, more than the $7 billion that 1.4 billion Chinese purchased. So there’s a lot of scope for the Philippines to boost export sales to nearby Hong Kong.

- A similar opportunity exists in the small but rich city-state of Singapore with average earnings of $57,700 of its 5.8 million people. From all over the world, Singapore bought $93.2 billon of electronic equipment (28 percent of its imports) and over $20 billion of precious metals including gold, a Philippine export. Tourism to the Philippines of Singaporeans (and others from wealthy countries) is big revenue potential.

- The closer relationship now than before between the world’s second largest economy China and the Philippines represents an ample chance of selling more agricultural and marine products to this country having the largest population on the planet, in addition to its current purchases of storage units, integrated circuits, semiconductors, and nickel ore.

In sum, above are some of the ways we have outlined to grow the Philippines’ export sales volume. The important point to remember is that we must keep learning, and then doing.

Kumar (Kem) Balani has an AB Journalism degree from the University of the Philippines and an MA in Politics from New York University. He is founder and publisher of Biz India Online News since 2002. Go to www.BizIndia.net to read book reviews, features, news, opinion columns, and videos on business, entertainment, investing, law, sports, technology, and more.

This column first appeared in Daily Tribune in the Philippines on Sunday, January 06, 2019. Read Kumar Balani’s columns in that newspaper: http://tribune.net.ph/index.php/author/kumar-balani/