By Mike Larson

Friday, June 8, 2012 at 7:30am

In all my years of following the interest rate markets, I can’t recall a moment like this. The so-called “experts” on Wall Street are completely, utterly obsessed with a simple question: “Will Fed officials wave their magic monetary wand again or won’t they?”

You want to hear MY shocking answer? Who the heck cares!!

I know it’s almost heresy to speak such words. Certainly the people trying to sell ads on CNBC, or the Fed “mouthpiece” reporters at various media outlets, don’t want to hear them.

And many observers enjoy nothing more than blathering on endlessly about things like the latest comments from Ben Bernanke, who testified before Congress yesterday. (My very brief take: He punted to fiscal policymakers here and European politicians overseas, saying they need to do the heavy lifting, not the Fed.)

But the simple fact is, Fed policymakers and their counterparts overseas are becoming increasingly irrelevant. Let me explain why …

The level of interest rates is NOT the problem,

so more “QE or Quantitative Easing (Printing of Paper Currency) would be essentially useless!

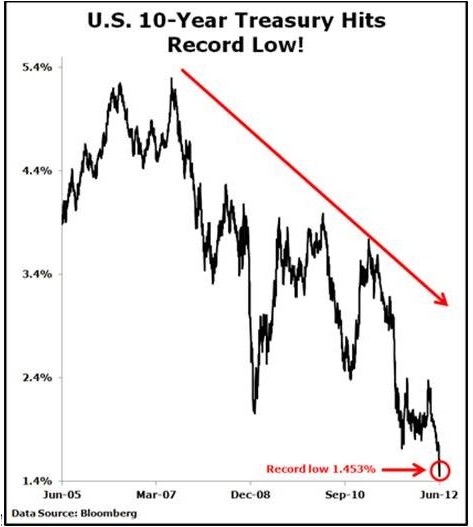

Take a look at this chart of the 10-year Treasury Note yield. You can see it has been trending down and down and down for months on end. In fact, it just plunged to 1.453 percent. That’s the lowest in recorded U.S. history!

Meanwhile, U.S. 30-year mortgage rates just hit 3.75 percent, according to Freddie Mac. That’s the lowest the company’s survey has ever found, even lower than the super-low rates we had in the wake of World War II. You can now get a 15-year mortgage for less than 3 percent!

That means home financing has never been as cheap as it is now. Yet the housing market is far from booming. Instead, it’s just kind of sitting there like a bump on a log.

So I have a simple question to all the Fed watchers hanging on Ben Bernanke’s every word: If the lowest long-term government borrowing rates … and the lowest long-term mortgage rates … in the history of the world aren’t causing the economy or home sales to surge, why would even lower rates matter?

What’s that? You don’t have an answer? I’m shocked!

And while I’m at it, here’s another shocking prediction for you: QE3 might not even lower rates at all! I say that because the Fed’s OWN researchers at the San Francisco Fed have concluded that QE is having less and less of an impact!

Their recent study concluded that QE1 lowered long-term rates by 100 basis points, but that QE2 only caused them to drop by 14 basis points. That’s 0.14 percent. Or assuming a drop in the recent national average mortgage rate from 3.75 percent to 3.61 percent … on a $200,000 mortgage … a “whopping” savings of about $16 per month. Break out the champagne, right?

And again, that’s assuming that an 86 percent decline in effectiveness between QE1 and QE2 won’t be followed by ANOTHER decline in effectiveness between QE2 and any QE3 program. I think that kind of assumption is extraordinarily generous.

So like I said at the outset, the Fed is now largely irrelevant!

More European Speculation

Getting Tiresome Too!

Then there’s all the chatter coming out of Europe. Will Germany back Eurobonds or won’t they? Will the regulations be changed so the bailout funds Europe put together be able to directly recapitalize banks versus lend to governments? Will we get another “LTRO” program from the European Central Bank (ECB), or won’t we?

Here’s what I urge you to do when you hear the “experts” debating this stuff: Plug your ears!

The central bankers and fiscal policymakers over there have already tried virtually everything to prop up their economies and capital markets. Yet it isn’t working! Even the ECB all but threw up its hands this week, admitting it had no new “bazooka” to save the day.

The Wall Street economists and money managers aren’t talking about these kinds of measures because they think they will actually work long term to the benefit of European citizens. They’re just going on TV and expressing their hopes — trying to grasp something, anything that will bail them out of their losing positions.

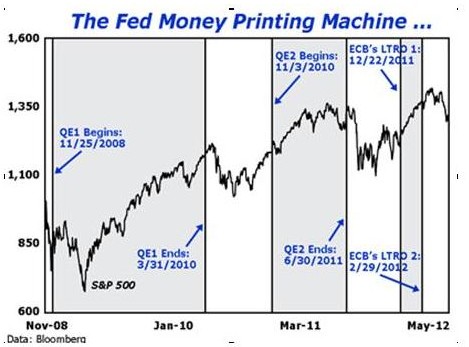

If you look at this chart below, you can clearly see that QE1 brought about a large, long-lasting rally in stocks because it was a new policy that shocked markets. But you can also see that QE2 prompted a much smaller rally, which lasted for less time, and which completely fell apart in only two weeks. Then you can see that the LTRO1 and LTRO2 programs from the ECB — essentially, QE-Europe — bought an even SMALLER rally that lasted even LESS time.

The cold, hard reality is that the only long-term solution out there is a period of deleveraging, slow or no economic growth, and falling asset values. That would allow the global economy to purge the excesses of the past several years of bubbles brought about by too-easy money, and allow assets to “reset” at levels attractive for bargain hunters to start buying.

None of this precludes short-term rallies from time to time. But it’s precisely why I told you months ago to take profits and add hedges … long before we had the worst month for global stock and commodity markets in years!

I’ll go a step further today: If we do get another sharp rally or two, brought about by the misguided notion that more QE will actually work … sell into it. As my fundamental and technical analysis shows, it should prove completely ineffective over the longer term.

Until next time,

Mike