Student loan debt now surpasses total credit card debt in the United States. While you hear horror stories about credit card debt all the time there is very little discussion on the epidemic of student loan debt.

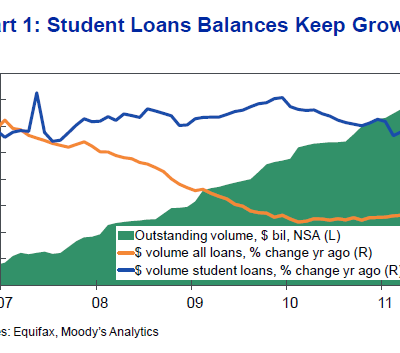

The chart here doesn’t account for the recent trend and it is very likely that we are quickly approaching $1 trillion in total outstanding student loan debt.

Keep in mind that the above chart doesn’t cover the total cost of education as you also have many students financing books and other expenses on their credit cards compounding the debt burden.

A just released survey from Western Union provides a unparalleled look at the summer real estate and mortgage market, student loan debt and generational debt and spending including:

29% of consumers plan to purchase a home in the next five years; 35% of consumers are carrying $1000 or more in student loan debt; Gen Y has recently added more bills than any other demographic…

The Western Union Payment’s Money Mindset Index survey also reveals:

STUDENT DEBT:

- 78% of women will have debt related to their education of $5,000 or more versus 74% of men

- 12% of women and 2% of men say they will have zero debt related to their education

- Approximately one in four graduating students with education debt will move back home after graduation

- 12% of students say they “may not graduate” because of the amount of debt they owe

- 21% said that their grade have suffered due to the amount they owe in debt

REAL ESTATE:

- 47% of the nation’s 70 million Gen Y (Bureau of Census) plan to purchase a home in five years or less, compared to 29% of the overall population

- 64% of consumers own a home, versus 65% this time a year ago.

- Collectively, 40% of home owners believe the housing market will remain stable with no changes compared to 2011

- 35% of homeowners believe the economy will improve this year

- 11% of Gen Y; 20% of Gen X; 22% of Baby Boomers are considering purchasing a second home

- 10% of Gen Y anticipates purchasing a home in the next 12 months

- 18% of consumers have made modifications to a current mortgage in the past 12 months

- 32% of Gen Y believes that using a recurring mortgage payment tool is helpful in keeping mortgages current

GENERATIONAL BILL PAYMENT:

- 55% of those surveyed are paying more bills online and 46% prioritizing which bills get paid first, paying more bills in cash [22%] and using a walk-up location [18%]

- Gen Y has added more bills than any other age segment [22%] and are planning to spend more than any other segment across categories: 28% on clothing, 21% on vacations, 34% on groceries and 17% on personal care.

- 20% of Gen Y has used an urgent or same day payment in the past six months

- Gen Y significantly outspends other generational segments on leisure time activities:

- -Hobbies: 18% Gen Y versus 9% all other

- -Electronics or Video Games: 14% versus 7%

- -DVDs, CDs, downloadable music & film: 12% versus 6%

- -Recreation (Gym memberships/sports gear): 12% versus 7%

- -Tickets to movies, sporting events or shows: 15% versus 10%

- Gen Y has 20% new student loan debt as compared to 11% all other consumers (11%)