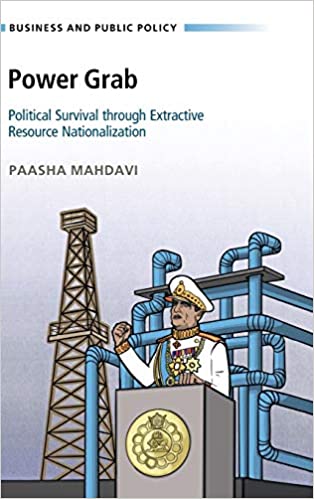

Author: Paasha Mahdavi

Publisher: Cambridge University Press – 258 pages

Book Review by: Sonu Chandiram

Paasha Mahdavi writes at the outset of this book that on September 1, 1969, Muammar Qaddafi, then a 27-year-old upstart rebel, seized power in the Kingdom of Libya by overthrowing the monarchy in that country led by the Sanusifamily.

Heading the Revolutionary Command Council, he promised political stability to the 21 American and European oil firms that operated in that fourth-largest oil-producing country in the world. The oil firms’ disunity gave him immediate leverage.

He took control of those oil firms’ assets, beginning with the British Petroleum’s Sarir oil field, in December, 1971. Not much later, by 1973, Qaddafi had already placed the operations of all foreign oil firms within his personal control through creation of the Libyan National Oil Corporation (Linoco).

What happened in October of that year – the global oil shock – had grave economic effects to the people of all oil-importing countries. A Wikipedia article describes the events:

“The 1973 oil crisis began in October when the members of the Organization of Arab Petroleum Exporting Countries (OPEC) proclaimed an oil embargo. targeted at nations perceived as supporting Israel during the Yom Kippur War. The initial nations targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States, with the embargo also later extended to Portugal, Rhodesia and South Africa.

By the end of the embargo in March 1974, the price of oil had skyrocketed nearly 300 percent from US$3 per barrel to nearly $12 globally. What’s more, U.S. oil prices were significantly higher, and placed economic pain on drivers. This embargo caused an oil shock, with many short- and long-term effects on global politics and the global economy.”

When the global oil shock occurred, Qaddafi controlled ‘enormous resources,’ accumulating over $2 billion in gold and foreign exchange reserves from petroleum sales in just the first nine months of 1973.

While what Qaddafi did to gain political and economic power has been frowned upon, the essential thesis of this book is this, as the author Paasha Mahdavi puts forth in his first chapter:

“If political rulers’ first struggle is gaining power, strategically securing the means to accrue and retain that power is a close-run second.”

To provide you a brief overview of what you will find discussed in this book, this is its outline of topics:

- The Puzzle of Extractive resource Nationalization

- The Theory of Political Survival Through Nationalization

- Defining and Measuring Operational Nationalization

- Why Nationalize? Evidence From National Oil Companies Around the World

- NOCs, Oil Revenues, and Leadership Survival

- The Dynamics of Nationalization in Pahlavi Iran

- Conclusions: The Implications of Nationalization

Professor Mahdavi notes that for political leaders whose lands “are blessed with extractive resources such as petroleum, metals. minerals, and other precious commodities – converting natural wealth into fiscal wealth – is key.” He exhorts them to not squander the opportunity to secure these assets that can create ongoing income for all people living in those countries.

Author:

Paasha Mahdavi is Assistant Professor of Political Science at the University of California in Santa Barbara. His research on energy governance and political economy has appeared in Comparative Political Studies, Nature Energy, and World Politics, among other journals, and has received media attention from The Financial Times, the Wall Street Journal, and the Washington Post.

Mahdavi earned his MS in Statistics and his PhD in Political Science from UCLA. He has held fellowships at the Initiative for Sustainable Energy Policy, the Payne Institute, and The World Economic Forum, and currently serves as Term member at the Council on Foreign Relations.

| World | Oil-Producing | Oil Reserves | % of World’s | 2017 Daily | 5-Year | 2017 GDP | World GDP | |||

| Rank | Country | (Billion Barrels) | Oil Reserves | Oil Prod. (Barrels) | Avg (+/-) | Per Capita | PC Rank (2017) | |||

| 1 | Venezuela | 303.2 | 17.90% | 2,100,000 | -22% | NA | NA | |||

| 2 | Saudi Arabia | 266.2 | 15.70% | 12,000,000 | 2.70% | $53,893 | 17 | |||

| 3 | Canada | 168.9 | 10.00% | 4,800,000 | 29.20% | $46,510 | 24 | |||

| 4 | Iran | 157.2 | 9.30% | 5,000,000 | 30.40% | $20,885 | 65 | |||

| 5 | Iraq | 148.8 | 8.80% | 4,500,000 | 46.80% | $16,935 | 78 | |||

| 6 | Russia | 106.2 | 6.30% | 11,300,000 | 5.60% | $25,763 | 57 | |||

| 7 | Kuwait | 101.5 | 6.00% | 3,000,000 | -4.50% | $72,096 | 8 | |||

| 8 | UAE | 97.8 | 5.80% | 3,900,000 | 14.70% | $&4,035 | 7 | |||

| 9 | USA | 50 | 2.90% | 13,100,000 | 46.60% | $59,928 | 13 | |||

| 10 | Libya | 48.4 | 2.90% | 865,000 | -42.70% | $19,673 | 67 | |||

| 11 | Nigeria | 37.5 | 2.20% | 2,000,000 | -17.60% | $5,887 | 131 | |||

| 12 | Kazakhstan | 30 | 1.80% | 1,800,000 | 10.20% | $26,491 | 55 | |||

| 13 | China | 25.7 | 1.50% | 3,800,000 | -7.40% | $16,842 | 79 | |||

| 14 | Qatar | 25.2 | 1.50% | 1,900,000 | -1.20% | $128,647 | 1 | |||

| 15 | Brazil | 12.8 | 0.80% | 2,700,000 | 27.50% | $15,553 | 82 | |||

| Total | 15 | 1,579.4 | 93.40% | 72,765,000 | 23.7% | |||||

Source: USA Today, May 22, 2019