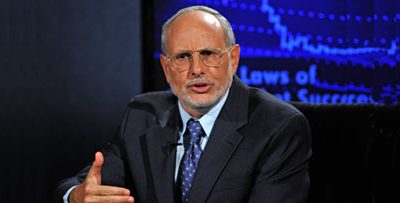

By Martin Weiss – Weiss Research

Monday, May 28, 2012

This is not the first time we’ve warned you about an imminent financial megashock.

In our Money and Markets of December 3, 2007, we specifically named Lehman Brothers as the next major firm to collapse on Wall Street. (See “Dangerously Close to a Money Panic.”)

In our Money and Markets of March 17, 2008, precisely 182 days before its failure, we again named Lehman, making it abundantly clear that it could be the trigger of a financial meltdown. (See “Closer to a Financial Meltdown.”)

And now, starting with last week’s edition, we are warning you of ANOTHER Lehman-type megashock.

A new telltale sign: Bank runs, the final nail in the coffin of any modern economy, are spreading among the PIIGS countries of Europe — and possibly beyond.

In Greece it’s already a tsunami — a desperate effort by millions of citizens to get their money out of danger before Greece is forced to leave the euro zone.

In Spain, it’s quickly turning into a flood, as individuals and businesses — with $1.25 trillion in total bank deposits — wonder if their country will be the next to leave the union.

In Portugal, Ireland, Italy or even France, banks are vulnerable to similar outflows. And once the stampede strikes more than two or three major countries, you could see bank runs all across Europe.

Sound Familiar?

It should. Because last year we witnessed a very similar contagion when investors stampeded from the bonds of the weakest European countries.

Much like today, the first to be attacked was Greece, the weakest link in the chain. Then, Spain, Portugal, Italy and even France got hit hard.

Soon, nearly all of Europe was infected, prompting its central bankers to suddenly break their solemn vows of monetary piety and print more than $1 trillion worth of new euros.

Now, despite all those efforts, they’re facing a new contagion of a second kind — by bank depositors.

But bank runs are far more infectious — and dangerous — than investor stampedes.

They spill out onto the streets and onto the airwaves.

They invoke frightening flashbacks to the Great Depression.

And they immediately threaten the entire banking system.

According to the New York Times, “the havoc that a stampede might cause to the Continent’s financial system would greatly complicate efforts by European Union officials to fashion a longer-term plan to ease the debt crisis and revive Europe’s economy, because authorities would have to cope with the staggering added costs of shoring up banks.

“‘A bank run can happen very quickly,’ said Matt King, an expert on international fund flows in London for Citigroup. ‘You are fine the night before, but on the morning after it’s too late.'”

And just as I explained here last week, the Times points out that it “was a similar liquidity crisis on Wall Street in September 2008 — which started with nervous investors pulling money from troubled institutions, then quickly from healthier ones — that set off the financial crisis.”

I repeat: It was just last Monday that I showed you how Europe and the U.S. are now on a collision course with a second Lehman-type megashock.

And here we are today, only seven days later, with the snowball of events bringing us a few steps closer.

Worse Than 2008?

Politicians and investors all over the world are now trying to prepare for the inevitable consequences. What they don’t seem to realize is that the next major megashock could be more severe than the Lehman Brothers failure.

Never forget the key differences between then and now:

• In 2008, it was strictly individual financial institutions that were on the edge of collapse. Today, entire nations are on the brink.

• In 2008, the U.S. federal deficit of the prior fiscal year was $161 billion. Today, it’s $1.327 trillion, or 8.2 times larger.

• In 2008, most of the megabanks at the epicenter of the crisis were in the United States. Today, although some U.S. megabanks are still taking excessive risk, it’s primarily the far LARGER European banks that are in the most trouble. In fact the weak European banks are so large, their total assets are greater than the total assets of ALL U.S. commercial banks combined.

• In 2008, governments had not yet deployed their “big gun” cures for the debt crisis. So they still had the firing power to squelch the crisis with a series of unprecedented rescues. Today, we have seen the rapidly diminishing returns — or outright failure — of nearly every possible stimulus plan, bailout deal or austerity measures known to man.

• In 2008, governments encountered little public resistance to major new policy initiatives. Today, millions of citizens are rebelling at the polls — or on the streets — in France, Greece, Portugal, Spain, Italy, and even Germany.

• Most important, until late 2008, central banks restricted their role to traditional manipulation of interest rates. Now, however, four of the most powerful central banks in the world (the Fed, ECB, BOE and BOJ) have departed radically from tradition and embarked on the greatest wave of money printing in the history of mankind.

So how can you prepare yourself for this type of megashock and its impact on the markets? For an answer let’s take a closer look at …

What REALLY Happened During

And After The Lehman Collapse …

Over a single weekend in mid-September 2008, the Fed chairman, the Treasury secretary, and other high officials huddled at the New York Fed’s offices in downtown Manhattan.

They seriously considered bailing out Lehman, but they ran into two hurdles:

First, Lehman’s assets were too sick — so diseased, in fact, even the federal government didn’t want to touch them with a 10-foot pole. Nor were there any private buyers remotely interested in a shotgun marriage.

Second, foreshadowing the public rebellion that would later bust onto the scene in the Tea Party movement, there was a new sentiment on Wall Street that was previously unheard of:

A small, but vocal, minority was getting sick and tired of bailouts. “Let them fail,” they said. “Teach those bastards a lesson!” was the new rallying cry.

For the Fed chairman and Treasury secretary, it was the long-dreaded day of reckoning. It was the fateful moment in history that demanded a life-or-death decision regarding one of the biggest financial institutions in the world — bigger than General Motors, Ford, and Chrysler put together.

Should they save it? Or should they let it fail?

Their decision: To make a break with the past. To let Lehman fail.

“Here’s what you’re going to do,” was the basic message from the federal authorities to Lehman’s highest officials.

“Tomorrow morning, you’re going to take a trip downtown to the U.S. Bankruptcy Court at One Bowling Green.

“You’re going to file for bankruptcy.

“Then you’re going to fire your staff.

“And before the end of the day, you’re going to pack up your own boxes and clear out.”

As in the prior Bear Stearns failure, America’s largest banking conglomerate (JPMorgan Chase) promptly appeared on the scene and swooped up the outstanding trades. And as with Bear Stearns, the Fed acted as a backstop.

But Lehman’s demise was unique because it was thrown into bankruptcy and put on the chopping block for liquidation.

Exactly 182 days earlier, we warned that it could be the financial earthquake that changes the world. And it was.

Until that day, nearly everyone assumed that giant firms like Lehman were “too big to fail,” that the government would always step in to save them.

But that myth was shattered on September 15, 2008, when the U.S. government decided to abandon its long tradition of largesse and let Lehman go under.

A major U.S. money market fund, the Reserve Primary Fund, immediately suffered a direct hit in its portfolio from exposure to Lehman securities, pushing its share value below $1 — an unprecedented event that spread panic in the entire industry.

Money funds, mutual funds and other institutions refused to buy the short-term IOUs (commercial paper) that thousands of companies rely on for ready cash.

All over the world, investors recoiled in horror, abandoning short-term credit markets — the lifeblood of the global financial system.

Bank lending froze. Borrowing costs went through the roof. Corporate bonds tanked. The entire world seemed like it was coming unglued.

“I guess we goofed!” were, in essence, the words of admission heard at the Fed and Treasury. “Now, instead of just a bailout for Lehman, what we’re really going to need is the Mother of All Bailouts — for the entire financial system.”

The U.S. government promptly complied, delivering precisely what they asked for — a $700-billion Troubled Asset Relief Program (TARP), rushed through Congress and signed into law by President Bush in record time.

In addition, the U.S. government loaned, invested, or committed:

• $300 billion to nationalize the world’s two largest mortgage companies, Fannie Mae and Freddie Mac

• over $42 billion for the Big Three auto manufacturers

• $29 billion for Bear Stearns

• $150 billion for AIG, and $350 billion for Citigroup

• $300 billion for the Federal Housing Administration Rescue Bill to refinance bad mortgages

• $87 billion to pay back JPMorgan Chase for bad Lehman Brothers trades

• $200 billion in loans to banks under the Federal Reserve’s Term Auction Facility (TAF)

• $50 billion to support short-term corporate IOUs held by money market mutual funds

• $500 billion to rescue various credit markets

• $620 billion for foreign central banks

• trillions more to guarantee the Federal Deposit Insurance Corporation’s (FDIC’s) new, expanded bank deposit insurance coverage from $100,000 to $250,000

• plus trillions more in bailouts and for other sweeping guarantees.

Governments of the UK and the European Union followed a similar pattern.

And everywhere — both inside and outside of government, apologists for these mega-rescues argued that it was “the lesser of the evils,” the only way to save the world from an even direr fate.

They were wrong, and we told them so on September 25, 2008.

That’s when Safe Money Report editor Mike Larson and I submitted a white paper to the U.S. Congress specifically documenting why the government bailouts would ultimately transform the debt crisis into a sovereign debt crisis.

Sure, governments can bail out big banks, brokers and insurers, we argued. But when the next crisis strikes, who will bail out the governments?

At the time, no one even bothered asking the question. Now, the question is everywhere.

But no one has an answer.

Yes, with trillions in bailouts since the 2008 debt crisis, the governments of the U.S. and Europe were able to calm the waters and restore credit markets.

But no government anywhere can create wealth and prosperity with worthless paper.

And no government can repeal the laws of gravity or change the laws of thermodynamics:

• When investors sell bad government bonds, the value of those bonds must plunge, making it next to impossible for those governments to borrow.

• When savers run to safety, money must flood from the weakest banks to the strongest, making it impossible for the weak banks to survive.

That’s what’s happening now and what will continue to happen in the weeks ahead — until and unless the authorities unleash a new wave of money printing that makes previous waves look puny by comparison.

Stand by for our team’s specific instructions on how to protect yourself and profit.

Good luck and God bless!

Martin