New Delhi, July 05, 2019 – The Indian economy grew at 6.8 percent a five-year low, in 2018-19 and fourth quarter growth slumped to 5.8 percent which was a 17-quarter low. Prime Minister Narendra Modi has urged states to work together to make India a $5-trillion economy by 2024.

India will be a $3 trillion economy in 2019-20, said India’s Finance Minister Nirmala Sitharaman while presenting her maiden Union Budget on Friday to the Indian Parliament.

“Our economy was $1.85 trillion when we assumed power (in 2014) and it reached $2.7 trillion (in five years since),” said Sitharaman while outlining her government’s commitment to make India a $5 trillion economy by 2024.

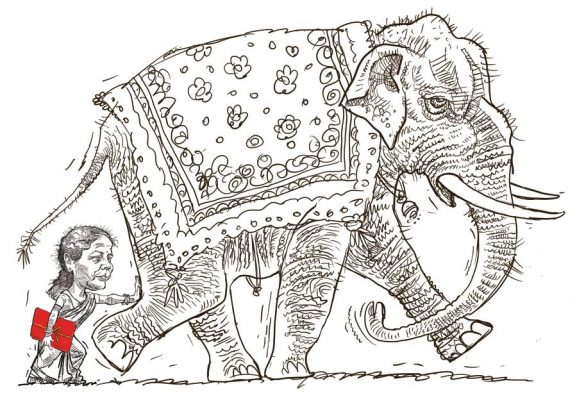

India’s Finance Minister Nirmala Sitharaman addressing Parliament (photo credit Asian News International)

(Editor’s note: $5 trillion is about the current size of the world’s fourth largest economy – Japan. However its GDP per capita is about $39,300, unlikely to be anywhere close to that for India in 2024, which is currently $2,036).

However, she added India would need investment in infrastructure, digital economy and job creation in small and medium enterprises to achieve the government’s vision of $5 trillion economy.

“I am confident we will achieve our goals. With determined human effort, the task must be completed,” Sitharaman added.

In terms of Purchasing Power Parity (PPP), India has become the third largest economy in the world after the US and China, she said.

Prime Minister Narendra Modi, who returned to a second term in office in May, has urged states to work together to tackle socio-economic problems, and make India a $5-trillion economy by 2024, which he said was a “challenging, but achievable” goal.

The jumbo project begins as Sitharaman takes the first steps to propel India into the league of $5 trillion economies. Sitharaman’s debut effort was also cognizant of the pressing ground realities; problems, which, if ignored, could balloon into a crisis

In the end, the debut budget of Nirmala Sitharaman and also the first of the 17th Lok Sabha matched initial expectations. Like the previous efforts of the National Democratic Alliance (NDA), it was bereft of the fancy flourishes that play to the galleries in Delhi and Mumbai and have rarely translated into follow-up policy action. Instead, it was a classic from the Bharatiya Janata Party-led NDA playbook, which gives Bharat centre stage. Moreover, it implicitly incorporates the “nudge” economy as its underlying strategy. Here are five takeaways.

- We’ll achieve 8 percent growth from this year. $5 trillion GDP by 2024 not far-fetched: Sitharaman. As an economic document and in what should be a surprise to pundits who were batting for a countercyclical stimulus, the Union budget stuck to the dharma of fiscal restraint. Not only did it not succumb to temptation in what is fiscally a very difficult year, but it also actually committed to lower the fiscal deficit (or gross borrowings of the government). One may quibble with the underlying assumptions, some of which potentially err on the side of optimism by setting ambitious targets for tax collections and non-tax receipts (especially with respect to realizing the over the Rupees 1 trillion disinvestment target in the next eight months). And, projecting a modest growth in expenditure of around 13 percent despite taking on additional spending under its various social welfare programs and packages to alleviate farm distress — the allocations for agriculture are projected to grow by a staggering 75 percent this fiscal year.

- Typical of a Modi-era Union budget, the Sitharaman budget had its usual fare of out-of-the-box ideas. The standout one was the paradigm shift undertaken in the financing of the Union budget. Part of the fiscal deficit will be funded through government borrowings from abroad. The underlying idea to dollarize the fiscal deficit is to avoid crowding out private capital from the domestic markets and at the same time avail of the low interest rates prevailing abroad thanks to the glut of money.

- The budget also reflected the certitude of thought that has prevailed in this government, most apparent in the move to push through the demonetization of high-value currency notes. Similarly, it ruled unequivocally in favor of electric vehicles and, in the process, underlined its willingness to walk the talk on a green economy. And this, despite the heartburn it will cause to automobile lobbyists, who were batting for combustion engines, or at the least delay the roll-out of electric vehicles or EVs.

- Interestingly, Sitharaman’s debut effort was also cognizant of the pressing ground realities: problems, which, if ignored, could balloon into a crisis. In this context, it was significant that the Union budget threw a lifeline to ailing non-banking financial companies (NBFCs). Not only will it provide the much-needed liquidity, it will also prevent the present crisis from degenerating into a contagion.

- Finally, Sitharaman’s budget got the optics spot on. By making Bharat the central focus, it has been able to stick to its mantra of being pro-poor and pro-business. The last time it showcased its pro-business credentials with its push for a new land acquisition law, it was accused of being a “suit-boot sarkar”.

Her carefully crafted 127-minute budget speech ensured that even the handouts to corporate India—like the increase in customs tariffs to protect domestic industry or the lifeline to non-banking finance companies or NBFCs—were carefully balanced:

Keeping with the Prime Minister Modi’s summation of India being made up of two classes—the poor and those who help the poor—Sitharaman targeted the top 1 percent with fresh direct tax cesses (assessments).

Consequently, high-income earners, especially those with income over Rupees 5 crore ($714,285) will now pay a maximum marginal tax of 42.74 percent (amounting to $305.285). The message to the rich is clear: it is time to pay back to your country, which gave you so much.