by Mike Larson

Friday, June 15, 2012 at 7:30am

If it seems like the European debt crisis has been going on forever, that’s because it has!

We’re watching a slow motion train wreck, frankly, one that’s continuing to follow a

predictable “Crisis, Response, Disappointment, Crisis” (CRDC) pattern …

First, for one reason or another, the simmering crisis explodes onto the front pages

of newspapers everywhere. The prices of bonds and stocks in the affected country (or

countries) tumbles, and volatility spikes.

Second, government officials or central bankers run around like chickens with their heads

cut off. They say “Oh no, we can’t have another ‘Lehman moment'” and they cook up

some half-baked plan on the fly to calm everyone down.

Third, the newfangled plan causes markets to spike temporarily. Stocks go up and

volatility goes down. But once the details of the plan start leaking out, investors realize

there’s no “there” there — the plan is more conceptual than concrete, or it won’t work as

structured. That leads to disappointment.

Fourth, investors once again realize that unless aliens from another planet arrive with

spaceships full of money, there simply isn’t enough cash floating around ANYWHERE

to bail out all the small PIIGS countries plus behemoths like Spain and Italy. So the crisis

explodes onto the front pages all over again, and we head back down!

What will finally end this cycle? What’s coming next? And what does it mean for you?

Here’s my take …

Why we’re stuck in this “CRDC” cycle despite hundreds of billions of euros in

bailouts!

If you go back to the private credit crisis in our country, you see something very much

like the European CRDC pattern played out. Some institution like Bear Stearns or Fannie

Mae would teeter and the markets would freak out. Government officials would intervene

with a bailout plan. Everyone would calm down for a while. But because the underlying

problems weren’t dealt with, the whole sorry process would play out again a few months

later.

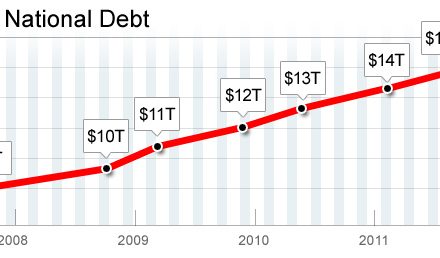

The biggest explosion of all came when Lehman Brothers was allowed to go down in the

fall of 2008. That caused a massive spike in volatility and a corresponding collapse in

financial markets. Government officials took home a bad lesson from that experience —

namely, that no matter what, they shouldn’t allow institutions to fail. They should instead

virtually bankrupt themselves throwing money at the problem, moral hazard be damned!

That brings me to today’s European crisis …

If officials had just let Greece repudiate its debts and exit the euro a couple of years ago,

we wouldn’t be where we are today. If officials had just let vulnerable Irish banks fail,

and troubled countries like Portugal “go,” we wouldn’t be stuck in this perpetual CRDC

cycle.

Sure, it would have been much uglier in the SHORT TERM. Markets would have fallen

and volatility would have surged. But it also would have cleared the unpayable debts off

the balance sheets of these governments, eliminated “zombie banks” from dragging down

healthier institutions, and allowed the LONG TERM healing process to get underway.

Instead, policymakers chose to be short-sighted … They bailed out Greece once, then

bailed them out again. They bailed out Irish banks … the Portuguese government … and

then a week ago, they pledged 100 billion euros to shore up tottering Spanish banks. All

of those programs were designed with a simple goal in mind: Prevent another “Lehman

moment” in the short term, regardless of the long term consequences!

Here’s the catch: You can’t prevent the inevitable forever!

So why after each response, has disappointment always reemerged — and the European

continent slipped back into crisis? Because you can’t prevent the inevitable forever! The

only real solution here is repudiation of unpayable debts, the exit from the euro currency

union by countries like Greece, and the failure of large, vulnerable European financials.

I don’t care how many European politicians lie to you and tell you otherwise. I don’t care

how many euros, yen, pounds, or dollars central bankers print as part of temporary, stop

gap, papering-over-the-problem programs. That’s the bottom line, and there’s no getting

around it. So the takeaway for you is simple: You have to play the cycle …

First, sell stocks and other risk assets during times of calm. Or buy inverse ETFs or put

options if you’re more aggressive.

Second, take profits on those downside hedges whenever we get a big crisis-driven

swoon, then if you’re more aggressive, add some cheap upside plays to ride the inevitable

bailout rally.

Third, once those rallies peter out, repeat step one! That way you’ll be positioned for the

next crisis-driven collapse. That’s what I’ve been doing, and will continue to do until the

endgame finally arrives. Only then — when the repudiation, failures, and big collapses

occur — will I likely do some LONGER TERM bottom fishing. That’s because only then

will assets be truly cheap for more than a trade!

Until next time,

Mike